The Main Principles Of Paul B Insurance

Wiki Article

The Best Strategy To Use For Paul B Insurance

For instance, let's suppose you die an untimely fatality each time when you still have several landmarks to attain like kids's education, their marriage, a retired life corpus for your spouse etc. There is a financial obligation as a real estate finance. Your untimely demise can put your household in a hand to mouth situation.

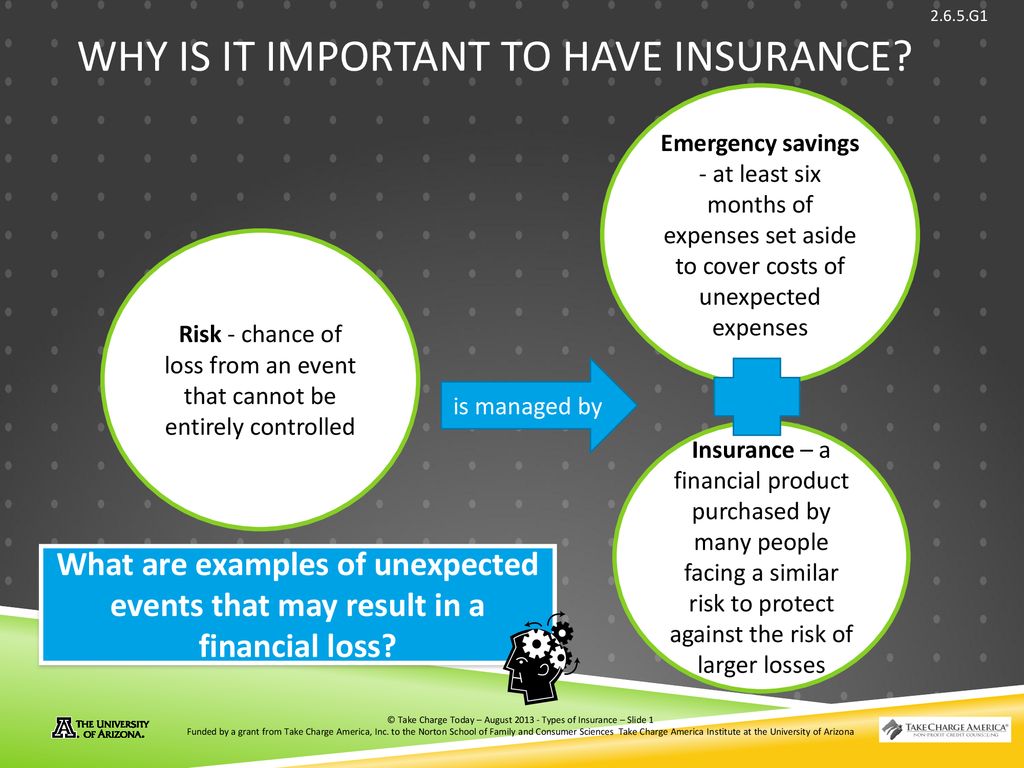

Despite how tough you try to make your life much better, an unexpected occasion can completely turn points upside down, leaving you literally, emotionally as well as monetarily strained. Having appropriate insurance assists in the feeling that at the very least you don't need to think regarding cash during such a tough time, and also can concentrate on healing.

Having health insurance coverage in this instance, saves you the concerns as well as stress of setting up cash. With insurance in place, any kind of economic stress will be taken treatment of, and also you can focus on your recovery.

The smart Trick of Paul B Insurance That Nobody is Discussing

With Insurance making up a big component of the losses organizations and family members can jump back rather conveniently. Insurance policy business pool a large quantity of money.

Within this time they will accumulate a large quantity of wealth, which returns to the financier if they survive. If not, the riches goes to their family members. Insurance is a necessary financial device that aids in managing the unanticipated expenditures smoothly without much headache.

There are generally 2 kinds of insurance policy and also allow us recognize how either is relevant to you: Like any liable individual, you would certainly have intended for a comfy life basis your revenue and also career forecast. They also provide a life cover to the insured. Term life insurance is the pure form of life insurance coverage.

If you have a long time to retire, a deferred annuity provides you time to invest for many years and also develop a corpus. You will get income streams called "annuities" till the end of your life. Non-life insurance policy is additionally described as general insurance coverage and covers any insurance policy that is outside the province of life insurance policy.

When it comes to non-life insurance coverage, factors such as the age of the property as well as deductible will additionally impact your option of insurance strategy. Forever insurance coverage plans, your age and also health and wellness will influence the costs cost of the strategy. If you have an automobile, third-party insurance policy coverage is compulsory before you can drive it on the road.

The Best Guide To Paul B Insurance

Disclaimer: This write-up is provided in the basic public interest and also meant for general details purposes only. Viewers are recommended to exercise their care and not to count on the materials of the short article as definitive in nature. Viewers ought to investigate more or speak with a professional in this regard.

Insurance is a legal arrangement in between an insurance firm (insurance company) and also a private (insured). In this instance, the insurance business ensures to make up the guaranteed for any kind of losses sustained due to the covered contingency occurring. The contingency is the incident that leads to a loss. It may be the insurance holder's death or the property being harmed or damaged.

The main features of Insurance coverage are: The essential function of insurance is to safeguard versus the opportunity of loss. The moment as well as quantity of loss are unforeseeable, and if a risk occurs, the individual will incur a loss if they do not have insurance. Insurance guarantees that a loss will be paid and also consequently safeguards the insured from enduring.

official sourceAn Unbiased View of Paul B Insurance

The procedure of figuring out costs rates is likewise based on the policy's threats. Insurance provides settlement assurance in the event of a loss. Better planning as well as management can help to reduce the danger of loss (Paul B Insurance).

There are numerous secondary functions of Insurance coverage. These are as complies with: When you have insurance policy, you have guaranteed money to pay for the treatment as you get correct economic assistance. This is among the essential additional features of insurance whereby the basic public is shielded from disorders or crashes.

The function of insurance policy is to alleviate the stress and anxiety as well as anguish connected with fatality and also property devastation. An individual can dedicate their body and heart to better achievement in life. Insurance policy supplies a motivation to work hard to far better individuals by safeguarding society versus enormous losses of damages, damage, and fatality.

HomepageThe 8-Second Trick For Paul B Insurance

There are numerous roles as well as significance of insurance policy. Some of these have been given below: Insurance coverage cash is bought countless initiatives like water supply, energy, and highways, adding to the country's general economic prosperity. Rather than concentrating on a bachelor or organisation, the danger affects various people and also organisations.

It motivates danger control action since it is based on a threat transfer system. Insurance plan can be utilized as collateral for credit rating. When it comes to a home finance, having insurance protection can make acquiring the funding from the lender less complicated. Paying taxes is one of the major duties of all residents.

25,000 Area 80D People as well as their family members plus moms and dads (Age much less than 60 years) Complete Up to Rs. 50,000 (25,000+ 25,000) Section 80D Individuals and also their family plus parents (Age greater than 60 years) Total Up to Rs. 75,000 (25,000 +50,000) Area 80D Individuals and also their family(Anybody above 60 years of age) plus parents (Age greater than 60 years) Amount to Rs.

A Biased View of Paul B Insurance

All kinds of life insurance policy plans are offered for tax exception under the Income Tax Obligation Act. Paul B Insurance. The advantage is gotten on the life insurance policy, entire life insurance plans, endowment plans, money-back policies, term insurance, as well as Device Linked Insurance Policy Program.

This provision additionally permits for an optimum deduction of 1. 5 lakhs. Every individual needs to take insurance policy for their health. You can pick from the various types of insurance as per your requirement. It is recommended to have a health or life insurance policy policy since they verify useful in bumpy rides.

check out here

Insurance policy promotes moving of risk of loss from the insured to the insurance company. The standard concept of insurance is to spread risk among a big number of individuals.

Report this wiki page